Track mileage automatically

Get started.svg)

Free mileage log template

In this article

- Download the mileage log template as a spreadsheet or PDF

- Using the mileage template for your mileage records

- What to record in your mileage log

- Calculating mileage with the log book template

- How to automate your mileage log

- How to reimburse employees that drive a company car

- FAQ about the free HMRC mileage log template

- Download the mileage log template as a spreadsheet or PDF

- Using the mileage template for your mileage records

- What to record in your mileage log

- Calculating mileage with the log book template

- How to automate your mileage log

- How to reimburse employees that drive a company car

- FAQ about the free HMRC mileage log template

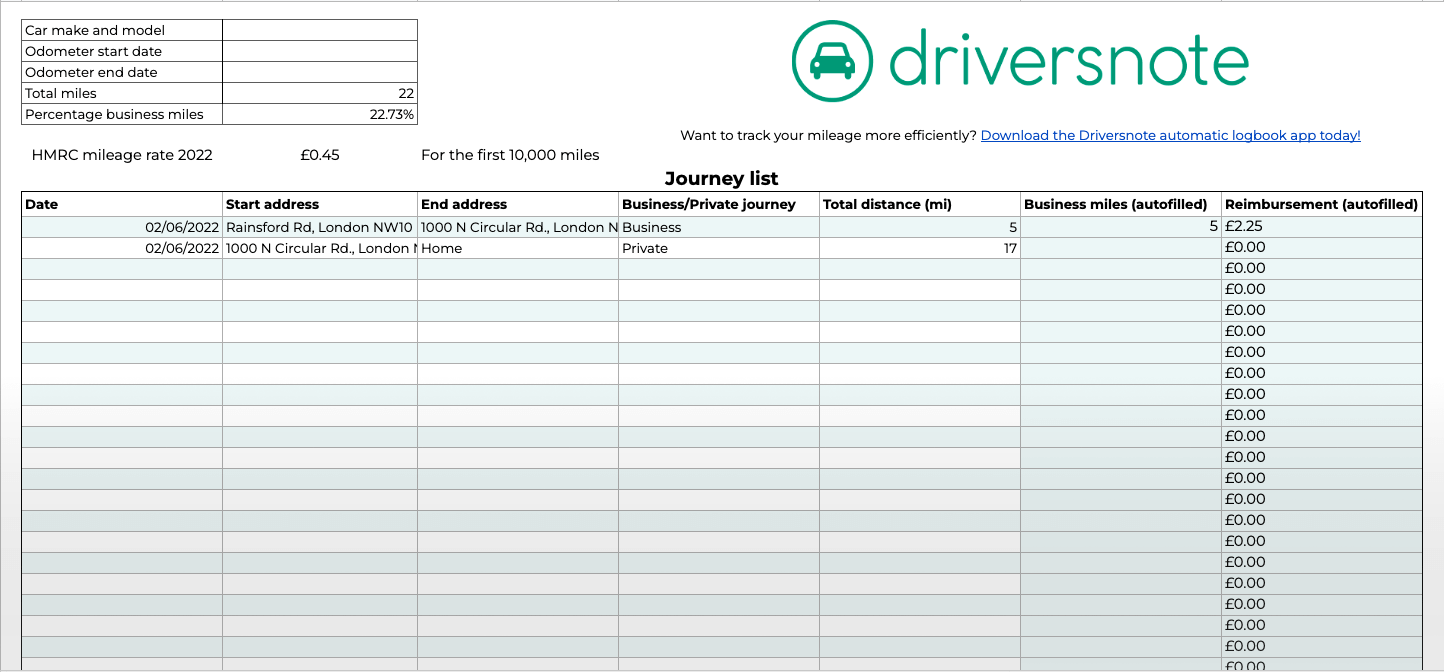

Whether you're an employee or a business owner, keeping good mileage records in the form of a mileage log book is critical. By using the HMRC mileage log template, you can fill out all the information needed for your company's mileage reimbursement or calculate the mileage allowance relief for your tax claim.

Automate your mileage log book with the Driversnote mileage tracker app.

Download the mileage log template as a spreadsheet or PDF

The template uses the standard HMRC mileage rate for 2025/2026 of 45p for cars and vans for the first 10,000 miles.

Note that after the first 10,000 miles, the HMRC approved rate changes to 25p per mile.

We designed this simple mileage sheet for you to easily log your trips and calculate your mileage allowance for the first 10,000 miles. While the sheet has the formulas to calculate everything for you, there is still quite a lot of manual work involved.

Mileage tracking made easy

Trusted by millions of drivers

Automate your mileage log Automate your mileage log

Automatic mileage tracking and HMRC-compliant reporting.

Get started for free Get started for freeUsing the mileage template for your mileage records

A mileage log is a year-long record of your business (and private if you use the same vehicle for both) trips required by HMRC or your employer for your mileage allowance payments. Keeping a mileage log is the most convenient way to ensure that your mileage payments are guaranteed. You can use this HMRC mileage log template for the UK to do just that.

With this template, you can log your trips and use the fields to generate the expected mileage payments automatically. The template can serve as a mileage log if you fill it out cautiously and make sure you don’t skip anything. However, you still need to make sure that you have logged every single trip and input the data correctly.

Learn more about HMRC mileage rates and mileage claims in our dedicated guide.

What to record in your mileage log

There are a few things you must always remember to note down. According to HMRC, a compliant mileage logbook should contain:

- The date and purpose of your trip

- The distance travelled

- Start and end address of each trip (including postcodes)

Look at our comprehensive explanation of what trip information you should record for an HMRC-compliant mileage log book.

Calculating mileage with the log book template

As you fill out the mileage log template (Excel and Sheets versions), your reimbursement will be calculated automatically with the applied formula.

Please remember that if you use the PDF version of the mileage log template, you will have to do the calculations manually.

Here’s an example of how to do that:

Let’s say you've been keeping track of your mileage for the last month, and you've gone 2,000 miles for business purposes. Your employer reimburses you at 45p per mile - the HMRC mileage rate. To find out how much you'll get compensated, multiply the number of miles by the rate:

[miles] * [rate], or 2000 x 0.45 = £900

How to automate your mileage log

With a mile tracker app, you can record trips automatically, so as long as you use the app properly to sort your trips, you shouldn’t have any issues, and the manual work will be significantly reduced. Most apps can help you be HMRC-compliant, but you must ensure you log everything correctly and not miss any details according to the tax authority requirements.

When you use a mileage tracking app like Driversnote, you get a detailed record of all your trips that you can export as a PDF or Excel file and give to your boss or accountant. The report can be used as proof for mileage allowance payment claims or Mileage Allowance Relief from HMRC.

How to reimburse employees that drive a company car

If you're an employer and have employees that use a company car, you can still reimburse them, but use you a different rate. See the 2025 Advisory Fuel Rates for reimbursement in company cars.

Are you an employer claiming VAT on mileage? Read our full guide, see current rates, and use the calculator to learn how much you can claim.

FAQ about the free HMRC mileage log template

Tired of logging mileage by hand?

Effortless. HMRC-compliant. Liberating.

Top posts

- HMRC advisory fuel rates 2025

- Automate mileage tracking in healthcare with Driversnote Teams UK

- Driversnote Teams vs MileIQ for teams

Related posts

Free mileage log book template

Latest update: 7 May 2025 - 2 min read

Whether you're an employee or a business owner, it's crucial to keep good mileage records in a mileage log book.

HMRC Mileage Guide

Latest update: 2 April 2025 - 5 min read

Welcome to our guide on mileage claims and reimbursement in the UK. This guide will walk you through the rules that apply to your situation.

HMRC advisory fuel rates 2025

Latest update: 5 December 2025 - 5 min read

HMRC has announced the revised advisory fuel rates, effective 1 December 2025. See how they apply to employees and employers.