Your vehicle logbook is ready when needed

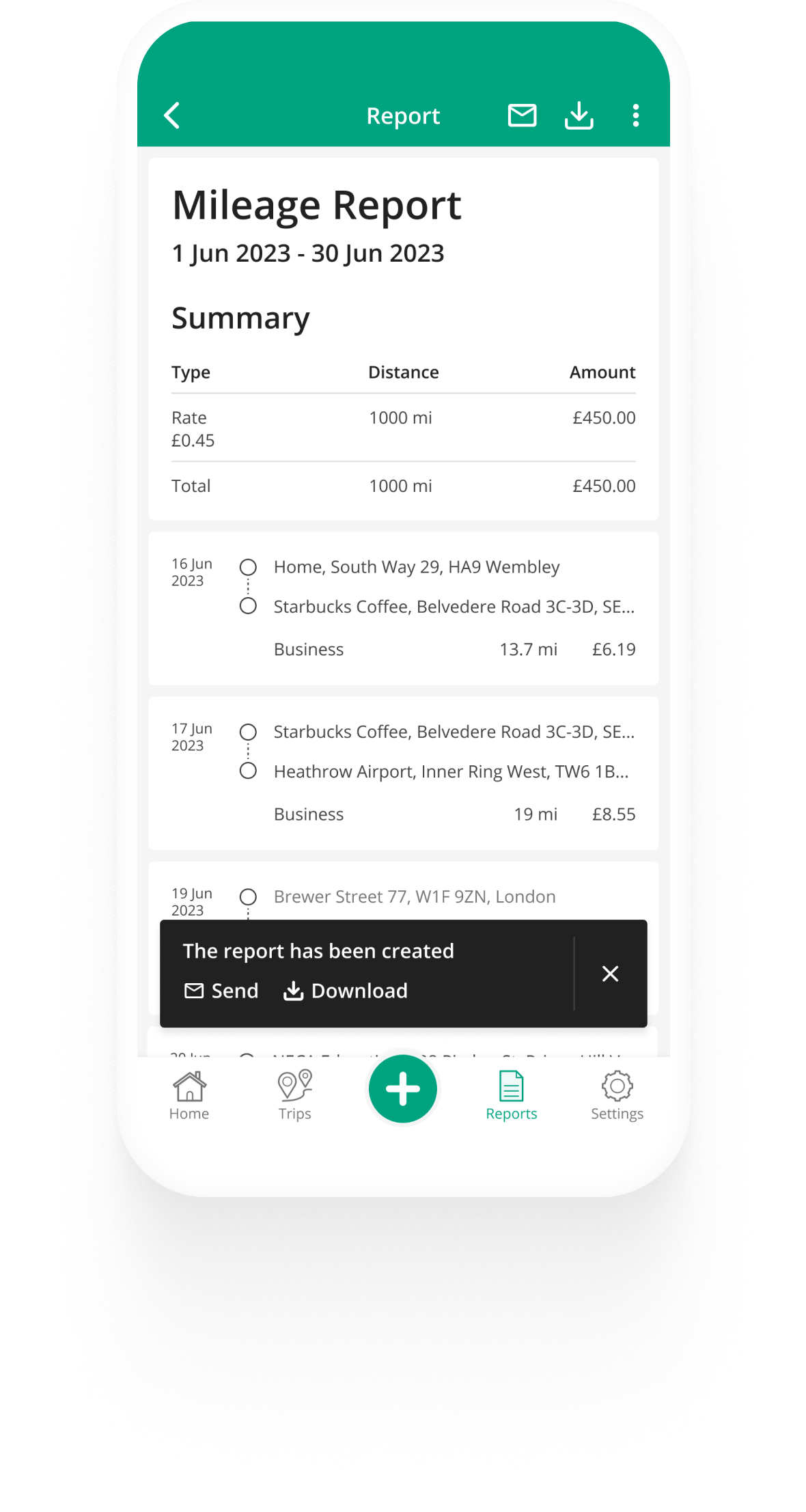

Your mileage logbook is ready when you are. You’re only one click away from a detailed vehicle logbook available on mobile or desktop.

Your mileage logbook is ready when you are. You’re only one click away from a detailed vehicle logbook available on mobile or desktop.

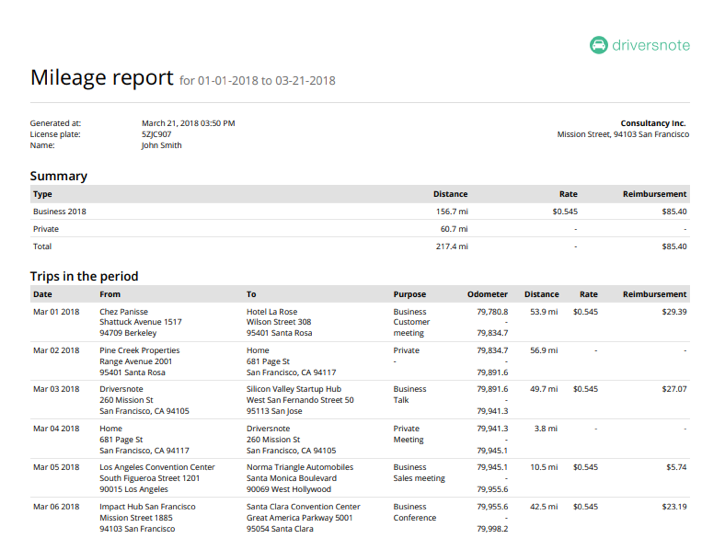

Get a customizable report of all your trips, downloadable as a PDF or Excel file, ready to hand over to your employer or accountant.

The report contains the details required by HMRC, ready to be used as documentation for your reimbursement claims or tax deduction.

From the get-go, your car logbook app automatically calculates reimbursements based on HM Revenue and Customs requirements that we keep up to date for you. If you’d like, you can set your own custom corporate rates or choose not to calculate reimbursements at all.

If you need to regularly document the status of your car’s odometer, we’ve got you covered. We make it easy to log and can even send you reminders. You choose how often to log the odometer, and we do all the math for you and include it in your report.

Do you need to keep a mileage log for multiple vehicles or report mileage to more than one employer? No problem. You can easily segment your trips and reporting for different vehicles and workplaces.

To keep a mileage log book in the UK, you should record details of every business journey you take, including the date, the start and end locations, the purpose of the journey, and the number of miles travelled. You can keep track of this information in a physical log book but we recommend using a mileage tracker app to save time and ensure accuracy.

To create a digital mileage log book in the UK, you can use a mileage tracking app such as Driversnote. Apps automatically track your mileage and store the information in a digital format, making it easy to access and export for tax purposes.

In the UK, HM Revenue & Customs requires that you keep records of your mileage expenses for at least 6 years. This means that you should keep your mileage log book or records for at least 6 years after the end of the tax year to which they relate. Keeping your records for longer than 6 years can be helpful in case of an HMRC investigation or audit.